Csonka: Breaking Down WWE’s 2019 Black Friday

In the past, mass WWE release days were nothing special. They were almost something to bet on at least once or twice a year. But the company had slowed their role on that in recent years, opting to keep talent rather than give anyone their scraps. Look how long it took guys like Rey & PAC to escape; you basically had to fuck up badly like Enzo and reportedly Cass to be released. In the past, these were dark days for many, but today, with ROH healthier than ever before, MLW on the rise and AEW about to launch, as well as the UK being more of an option than ever before, & Japan and Impact being an option for some, these releases may actually be a blessing for some. It’s a very new, exciting, and different time, that’s for sure.

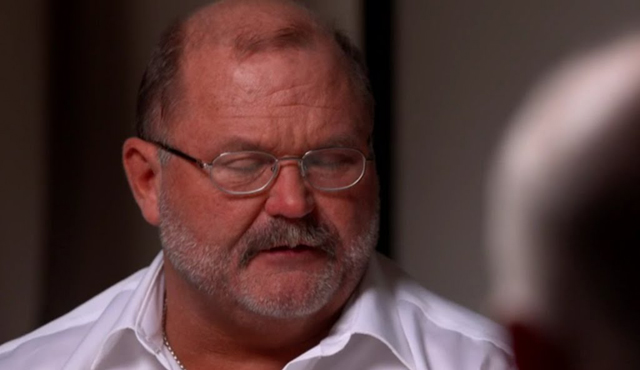

Arn Anderson : I feel that the release of Arn Anderson shouldn’t really come as a surprise to anyone. He had been with WWE since 2001 following the purchase of WCW, and was really the last of a dying breed in terms of agents from that era while over the years the agenting crew has become younger. The latest example of this are new hires Shane Helms, Shawn Daivari, Sonjay Dutt, Jeff Jarrett, Chris Parks, and the promotion of Steve Corino. I believe that this boils down to the company looking to skew younger and prepare for the future. There are also rumors of Arn’s personal issues being a problem (he’s had drinking issues in the past), but that being part of his release are just rumors at this time.

TJP: TJP came into the tournament with the nickname of “the world’s youngest veteran,” as he had pretty much worked everywhere, learned all the styles and had done pretty much everything he could outside of WWE. TJP felt like the safe choice to become the first champion. While not as flashy as Metalik, TJP’s style is versatile and allows him to work with a wide variety of opponents, plus there would be no language barrier. But the early days of the cruiserweight division were muddy; TJP only enjoyed a 46-day run before losing to Kendrick. Kendrick only lasted 30 days before falling to Swann. Swann made it 61-days before he fell to King Neville, who reigned for 197-days and then 35-days, with a 6-day Tozawa run sandwiched in there. Neville was a fantastic champion, but Vince saw money in Enzo and he got the belt for 15-days and then 93-days, with a 13-day Kalisto run sandwiched in there. The Enzo era came to an end, but TJP was a casualty of that run as he was almost deleted from WWE and was gone from TV for what seemed like ages. But when Triple H took over the show, TJP was back and had been a positive addition again, this time as a strong heel and continuing to have good matches. As a mid-card guy he was a stabilizing force, and still had championship potential. But there had always been rumblings that he rubbed the wrong people the wrong way, was difficult to work with and didn’t know when to shut his mouth. But with 205 not exactly being a big business show and ACH, Trevor Lee, and KUSHIDA signing with WWE and guys like DJZ being out there as free agents, a TJP dismissal is not surprising at all to me.

Hideo Itami: At the time of his signing, KENTA coming to WWE was a huge deal. He was a big star in Japan, and there were extremely high hopes for him to be a star. In my opinion, Itami’s WWE “failure” came down to a few things. First of all, he had trouble adapting. Part of this is due to WWE trying to reprogram him, and to be honest; they never allowed him to be KENTA. We saw glimpses of him at times, mainly on 205 Live, but on top of him never being himself, injury issues really held him back and ruined his NXT run. He got a chance with the move to 205 Live, But with 205 not exactly being a big business show and ACH, Trevor Lee, and KUSHIDA signing with WWE as well as guys like DJZ being out there as free agents, an Itami dismissal, just like TJP, is not surprising at all to me. There will be demand for him, and a return to NOAH seems very likely.

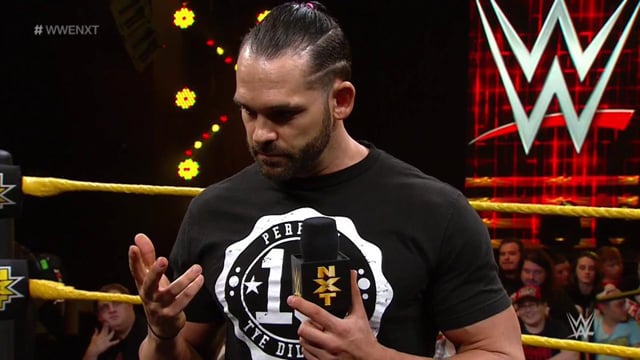

Tye Dillinger: By all accounts, Tye Dillinger’s dream job was with WWE, which tells you a lot considering he requested his release from the company. He worked hard, signed a developmental deal in 2006, had a WWE/ECW run as Gavin Spears, got released, worked his ass off to get re-signed in 2013 and became an NXT regular. He eventually fell into the “perfect 10” gimmick, got over huge and worked his ass off and got the main roster call up. Unfortunately, that was the beginning of the end. Admittedly, the gimmick had a certain shelf life, but he was called up with no plan, and did jack and shit on the main roster. Tye is a great role player, but wasn’t even used well in that way. Who can blame him for wanting out for a chance to work with his pal Cody in a company that on the surface is offering opportunity where other places haven’t. Tye was never going to be a main event guy, but he should have been a solid mid-card guy that can work with almost anyone with ease. It was only a matter of time until he wanted out, I’m just surprised it came so easily.

– End Scene.

– Thanks for reading.

“Byyyyyyyyyyyyyyyyyyyyyye Felicia!”

“Byyyyyyyyyyyyyyyyyyyyyye Felicia!”Echo Dot 3rd Gen Smart Speaker with Alexa only $24.99 (Black Friday price)

The Echo Dot (3rd Gen) Smart Speaker with Alexa is only $24.99 each when you buy 3 or $29.99 when you buy 2! These are the same low prices they offered on Black Friday!

The Echo Dot (3rd gen) is $49.99 each and if you buy 3, you get $75 off making them only $24.99 each at Amazon.com HERE!

If you buy 2, they are $29.99 each at Amazon.com HERE!

They will be in stock in multiple colors in March. See the availability dates for each color at Amazon.com HERE!

FREE Shipping: Amazon is offering FREE regular shipping on orders of $25 or more. If you have been considering an Amazon Prime Membership, you can try it out for FREE for 30 days! With Amazon Prime you get unlimited FREE two-day shipping (no minimum order size), thousands of movies and TV episodes to watch instantly, Kindle books to borrow, and early access to Lightning Deals and Black Friday deals.

You can get a 30-Day free membership when you sign up at Amazon.com HERE.

Amazon FREE Trials Amazon Music 30-Day Free Trial

Amazon is offering a 30-Day Free Trial Membership of Amazon Music Unlimited right now! This offer is available for anyone including Prime members and non-members!

This on-demand service allows users access to tens of millions of songs and hands-free listening. You can cancel at any time.

See all the details of this offer at Amazon.com HERE!

Amazon Kindle Unlimited 30-Day Free Trial

Amazon is offering a 30-day FREE trial to their Kindle Unlimited service with unlimited reading and unlimited listening on any device. You don't even have to have a Kindle to use the service.

With Kindle Unlimited, you have access to over 1 million titles including books, current magazines, audiobooks and more!

See all the details about this 30-Day Free Trial at Amazon.com HERE!

Audible 30-Day Free Trial

Amazon is offering a 30-day FREE trial of their Audible digital audiobooks service for Prime members and non-members!

With Audible, you can listen anytime and anywhere to the world's largest selection of digital audiobooks and spoken word content. Plus you get 2 free audiobooks and 2 Audible Originals to get you started. Plus, you can cancel at anytime.

See all the details of this offer at Amazon.com HERE.

Amazon FreeTime Unlimited 30-Day Free Trial

FreeTime Unlimited is an all-in-one subscription that gives kids access to thousands of kid-friendly books, movies, TV shows, educational apps, and games on compatible Fire, Android, iOS and Kindle devices. Plus, kids can enjoy hundreds of hours of fun with ad-free radio stations and playlists, Audible books, and a growing list of premium kid’s skills available on compatible Echo devices.

Parents also receive access to easy-to-use parental controls that allow them to find the right balance between education and entertainment. Parents can personalize screen time limits, set educational goals, filter age-appropriate content, and also manage web browsing and content usage based on their preferences.

See all the details of this offer at Amazon.com HERE.

CBS All Access 7-Day Free Trial

Prime Members can sign up for a free 7-day trial of the CBS All Access with Prime Video Channels at Amazon.com HERE.

Amazon Prime 30-Day Free Trial

If you have been considering an Amazon Prime Membership, you can try it out for FREE for 30 days!

With Amazon Prime you get unlimited FREE two-day shipping (no minimum order size), thousands of movies and TV episodes to watch instantly, Kindle books to borrow, and early access to Lightning Deals and Black Friday deals.

You can get a 30-Day free membership when you sign up at Amazon.com HERE.

Amazon Prime for Students 6-Month Free Trial

Amazon is offering a 6 month FREE trial of Amazon Prime for students!

Get unlimited FREE Two-Day Shipping (with no minimum order size), exclusive deals and promotions for college students, instant access to thousands of movies and TV shows at no additional cost, free unlimited photo storage, early access to Lightning Deals and more.

See all the details of this offer at Amazon.com HERE!

.

Smart Spending Resources is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

Black Friday in the UK, 2018 Report - Comprehensive Insight into the Consumer Dynamics and Spending Habits - ResearchAndMarkets.com

The "Black Friday in the UK - 2018" report has been added to ResearchAndMarkets.com's offering.

"Black Friday in the UK - 2018" offers a comprehensive insight into the consumer dynamics and spending habits of UK consumers for Black Friday The report analyses the market, the major players, the main trends, and consumer attitudes.

Spend during the Black Friday period is forecast to account for 10.5% of Q4 spend, with shopper penetration now up 5.0 ppts. Growth of Black Friday will continue to slow year-on-year given the prolific discounting throughout 2018 so far as retailers struggle to convince shoppers to spend.

Black Friday is the promotional shopping event that occurs in the last week of November, when many retailers offer discounts. While the official date of Black Friday in 2018 was Friday 23rd November, the Black Friday promotional period actually started on Monday 19th November, when many retailers started offering discounts in the week leading up to the day.

Black Friday has a big impact on the timing of purchases over Q4 - 39.9% of UK shoppers surveyed ahead of the event stated that they intended to purchase an item on promotion during the discounting period and of those shoppers, 55.8% planned to delay a purchase to benefit from anticipated reduced prices. It highlights how Black Friday is encouraging shoppers to hold back buying full price items as shoppers predict that retailers will drop prices even further during Black Friday, heavily impacting retailers' sales in the weeks prior to the event.

Average spends increased across the majority of categories. 65.7% of Black Friday purchases were made by consumers for themselves so consumers are showing a willingness to spend more over the Black Friday promotional period, particularly on treat items such as computers & tablets; entertainment; footwear; health & beauty items such as cosmetics; and specialty drinks. Conversely, categories which include more functional items such as DIY and floorcoverings saw average spend decrease.

Despite strong growth forecast in the electricals sector, it was not the driving force of Black Friday spend this year as other sectors outperformed. While the discounting event has primarily focused on this sector in the past, budget-friendly devices and softer demand for big-ticket items has ensured that certain categories such as major kitchen appliances and small domestic appliances are increasingly more of a replacement purchase, with fewer consumers looking to upgrade these items ahead of them breaking.

Scope

Reasons to Buy

Key Topics Covered:

THE KEY FINDINGS

- The Key Findings

- Black Friday has a growing impact on when consumers purchase in Q4, shifting sales patterns

- Majority of Black Friday spend is online, with Amazon being the star performer

- Consumers spent more on treats for themselves and others

- Trend insight - stores

- Trend insight - social media

- Trend insight - online

- Trend insight - anti Black Friday

CONSUMER ATTITUDES

- Key findings

- Black Friday shopper penetration

- Black Friday awareness

- Black Friday participation

- Barriers to purchase

- Financial wellbeing

- Black Friday spending

- Financing spending

- Purchasing dates

- Impact of timing

- Impact of Christmas spend

- Purchasing recipients

- Research

- Retailer promotions

- Consumer attitudes to deals

- Percentage of online spend

- Consumer preferences

- Consumer expectations

- Black Friday statements

- Retailer ratings - grocers

- Retailer ratings - non-food retailers

ELECTRICALS & TECHNOLOGY

- Key findings

- Retailer selection

- Channel usage

- Device usage

- Fulfilment

- Spending

- Retailer used

- Buying dynamics

- Amazon electricals

FASHION & BEAUTY

- Key findings

- Retailer selection

- Channel usage

- Device usage

- Fulfilment

- Spending

- Retailer used

- Buying dynamics

- Fashion & Beauty statements

ENTERTAINMENT & LEISURE

- Key findings

- Retailer selection

- Channel usage

- Device usage

- Fulfilment

- Spending

- Retailer used

- Buying dynamics

HOMEWARES, FURNITURE & DIY

- Key findings

- Retailer selection

- Channel usage

- Device usage

- Fulfilment

- Spending

- Retailer used

- Buying dynamics

SPECIALTY FOOD & DRINK

- Key findings

- Retailer selection

- Channel usage

- Device usage

- Fulfilment

- Spending

- Retailer used

- Buying dynamics

MISCELLANEOUS PRODUCTS

- Key findings

- Retailer selection

- Channel usage

- Device usage

- Fulfilment

- Spending

- Retailer used

- Buying dynamics

Companies Mentioned

For more information about this report visit https://www.researchandmarkets.com/research/j6hptp/black_friday_in?w=4

View source version on businesswire.com: https://www.businesswire.com/news/home/20190220005373/en/

SOURCE: Research and Markets

ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900 Related Topics: Retail

Copyright.

No comments:

Post a Comment